2 Subject to this Act the tax shall be charged on every ringgit. The Finance Act has amended the RPGT Act to the effect that from 1 January 2019.

All About Real Property Gains Tax Rpgt In Malaysia Propertyguru Malaysia Real Estate Infographic Real Property

A chargeable gain is a profit when the disposal price is more than the purchase price of the property.

. In a simple FIRPTA transaction the foreign seller and a buyer agree on a sales price for the US. This tax is provided for in the Real Property Gains Tax Act 1976 Act 169. Situation of interests options etc.

This Act may be cited as the Real Property Gains Tax Act 1976 and shall be deemed to have come into force on 7 November 1975. Short title and commencement 2. Examples of real estate include a home a condo land a commercial building.

For the period of 112022 and thereafter disposal in the sixth year after the date of acquisition of the chargeable asset is changed back to nil. While RPGT rate for other categories remained unchanged. RPGT Act Through The Years 1976 2022 RPGT is a tax on profit.

On the disposal of any real property hereinafter referred to as. The Foreign Investment in Real Property Tax Act of 1980 FIRPTA was enacted as Subtitle C of Title XI the Revenue Adjustments Act of 1980 of the Omnibus Reconciliation Act of 1980 Pub. For individuals citizens and permanent residents real property gains tax at the rate of 5 will be imposed on disposals of chargeable assets notwithstanding that the chargeable assets have been held by Malaysian.

Interpretation 1 In this Act unless the context otherwise requires accountant means an accountant as defined in subsection 1533 of the Income Tax Act 1967 Act 53. RPGTA was introduced on 7111975 to replace the Land Speculation Tax Act 1974. The departments Tax Equalization Division helps ensure uniformity and fairness in property taxation through its oversight of the appraisal work of local county auditors.

Intra-group transfers and reliefs. Real property company shares. Increase in real property gains tax rate.

The longer the property was held before disposal the lower the tax rate. The Act featured progressively-stepped tax rates corresponding to the holding period. Based on the Real Property Gains Tax Act 1976 RPGT is a tax on chargeable gains derived from the disposal of property.

Real Property Gains Tax 9 acquire. Folder_open Information on Taxes in Malaysia. Tax Base Ohio Revised Code 571303 571501 The real property tax base is the taxable assessed value of land and improvements.

This article outlines the main amendments to be made to the Real Property Gains Tax Act 1976 the Act pursuant to the Bill. Both Acts were introduced to restrict the speculative activity of real estate. This Act may be cited as the Real Property Gains Tax Act 1976 and shall be deemed to have come into force on 7 November 1975.

Part II discusses the provisions in the Real Property Gains Tax Act 1976 RPGT Act as at 31 March 2019 that directly impact the RPGT liability as well as compliance requirements. 3 - Society registered under the Societies Act 1966 wef 1 January 2022 consists of body of persons registered under any written law in. RPGT implications on death of an individual.

Every person whether or not resident is chargeable to RPGT on gains arising from disposal of real property including shares in a real property company RPC. The real property tax is Ohios oldest tax. The RPGT rates are as set out in Schedule 5 of the RPGT.

1 In this Act unless the context otherwise requires accountant means an accountant as defined in subsection 1533 of the Income Tax Act 1967 Act 53. Order Your 9789677000032 Online And Start Preparing Today. Amendments and additions to the Real Property Gains Tax Act 1976.

Rate 112010 - 31122011. The taxable value is 35 percent of true market value except for certain land devoted exclu sively to agricultural. Unannotated Statutes of Malaysia - Principal ActsREAL PROPERTY GAINS TAX ACT 1976 Act 169REAL PROPERTY GAINS TAX ACT 1976 ACT 1692Interpretation.

Can result in transfer of costs from seller to buyer with adjusted house prices. The USRPI pictured above. It means you have to pay 5 tax on profits of your sale.

It has been an ad valorem tax meaning based on value since 1825. 1 A tax to be called real property gains tax shall be charged. May slow down the housing market long-term.

Amendment of Section 21B which states that for companies where the property disposed is three years after the acquisition date the acquirer shall retain the sum not exceeding 5 of total value of price paid whichever is less. Real Property Gains Tax 3 LAWS OF MALAYSIA Act 169 REAL PROPERTY GAINS TAX ACT 1976 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. Real Property Gains Tax RPGT is a tax levied by the Inland Revenue Board IRB on chargeable gains derived from the disposal of real property.

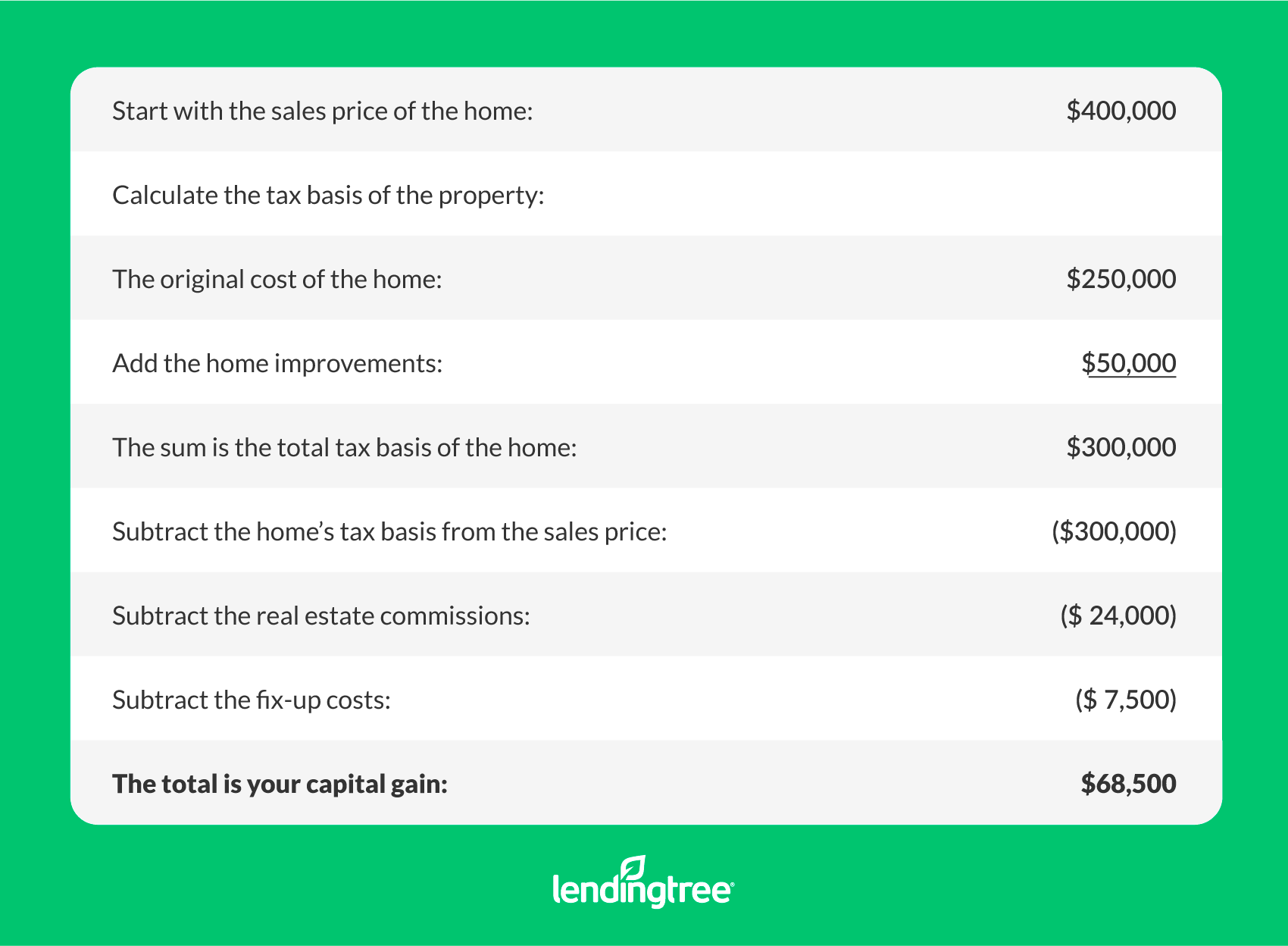

Rate of tax 5. The tax is levied on the gains made from the difference between the disposal price and acquisition price. Interpretation PART II IMPOSITION OF THE TAX 3.

These amendments come into force on 1 January 2022. RPGT rate for disposal of chargeable asset under Part I Schedule 5 RPGT Act. Taxation of chargeable gains 4.

As proposed by Tengku Datuk Seri Zafrul Abdul Aziz the RPGT rates as per Schedule 5 of the Real Property Gains Tax Act 1976. RPGT Payable Net Chargeable Gain x RPGT Rate based on disposable period RM170000 X 5 rate for 6th Year Thereafter RM8500. Net Chargeable Gain Gross Chargeable Gain Exemption.

The act was first introduced in 1976 under Real Property Gains Tax Act 1976 as a way for the government to limit property speculation and prevent a potential bubble. Real Property Gains Tax RPGT is administered by Inland Revenue Board of Malaysia under the Real Property Gains Tax Act 1976 RPGTA 1976. Ad Details On Real Property Gains Tax Act Changes Up To 15th March 1990 - Order Now.

What most people dont know is that RPGT is also applicable in the procurement and disposal of shares in companies where. RPGT is charged on chargeable gain from. RM180000 - RM10000 per transaction.

Real Property Gains Tax Act 1976 RPGT Act has authorised the Inland Revenue Board to impose Real Property Gains Tax RPGT on chargeable gains accrued from the disposal of real propertyRPGT is imposed on the gains made from the difference between the disposal price and acquisition price. In 1976 the Real Property Gains Tax RPGT Act was introduced to contain speculative activities in the real property market which had led to spiraling prices. Real Property Gains Tax Copy link.

All real property owners who are not specifi cally exempt are subject to the real property tax. This Act may be cited as the Real Property Gains Tax Act 1976 and shall be deemed to have come into force on 7 November 1975. On the day of closing the buyer receives the real estate but the seller doesnt get 100 percent of the agreed sales price.

When it comes to US capital gains tax on real estate for foreigners as per the FIRPTA act a. In furtherance of the 2022 Budget the Finance Bill 2021 the Bill was presented for its First Reading in the Dewan Rakyat House of Representatives of the Malaysian Parliament on 9 November 2021. According to state law and department rules auditors.

One of the highlights of the Budget 2022 is to remove the Real Property Gains Tax RPGT for the disposal of Real Property 1 by individual citizens and permanent residents starting from the sixth year and above. That means it is payable by the seller of a property when the resale price is higher than the purchase price. Budget 2019 RPGT Change increased from 5 to 10 for companies and foreigners selling after five years.

In accordance with this Act in respect of chargeable gain accruing. Short title and commencement.

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

Capital Gains Tax On A Home Sale Lendingtree

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Section 50c Of Income Tax Act Tax On Sale Of Immovable Property Tax2win

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

How To Save Capital Gain Tax On Sale Of Residential Property

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

How To Save Capital Gains Tax On Property Sale 99acres

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Real Property Gains Tax Portal Jabatan Penilaian Dan Perkhidmatan Harta Malaysia Property Management Taxact Management

Exemption From Capital Gains On Debt Funds Paisabazaar Com

Three Different Routes To Save Tax On Long Term Capital Gains Ltcg Just Like You Pay Tax On Income Earned Selling Y Capital Assets Capital Gain Share Market

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important